Exploring the significance of transparency in auto coverage plans, this article delves into the crucial role it plays in insurance policies. From potential issues stemming from a lack of transparency to the benefits it offers both insurers and insured individuals, this topic sheds light on the importance of clear and honest coverage plans.

Delving deeper into the key components and elements that should be clearly Artikeld in coverage plans, we uncover how policy details, limits, exclusions, and premiums contribute to transparency. Terms and conditions also play a vital role in ensuring policyholders have a clear understanding of their coverage.

Importance of Transparency in Auto Coverage Plans

Transparency plays a crucial role in auto insurance coverage plans as it ensures that policyholders fully understand the terms and conditions of their policy, helping them make informed decisions and avoid any surprises in the event of a claim. Lack of transparency can lead to various issues for policyholders, such as disputes over coverage, unexpected out-of-pocket expenses, and delays in claims processing.Benefits of Clear and Transparent Coverage Plans

- Enhanced Trust: Transparent coverage plans build trust between insurers and policyholders, as there are no hidden agendas or surprises.

- Better Understanding: Clear policy terms help insured individuals understand what is covered, what is not covered, and any limitations or exclusions.

- Efficient Claims Processing: Transparency in coverage plans streamlines the claims process, reducing the likelihood of disputes and delays.

- Improved Customer Satisfaction: When policyholders have a clear understanding of their coverage, they are more satisfied with their insurance provider.

Elements of Transparent Auto Coverage Plans

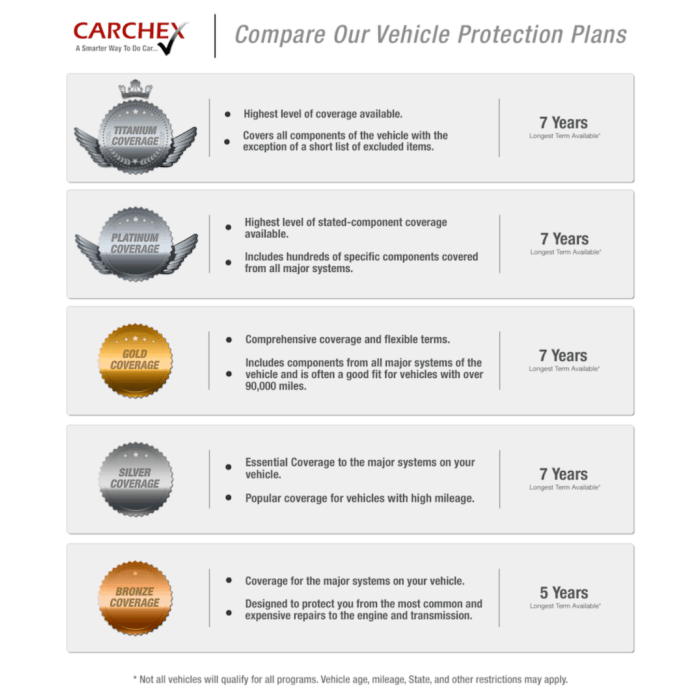

Transparency in auto coverage plans is crucial for policyholders to make informed decisions and understand the details of their insurance policies. By clearly outlining key components, such as policy details, limits, exclusions, and premiums, insurance companies can build trust with their customers and ensure a smooth claims process.Policy Details

- Policy details should include information on coverage types, deductibles, and any additional benefits or services provided by the insurance company.

- Clear and concise policy details help policyholders understand what is covered and what is not under their auto insurance policy.

Limits

- Insurance policies should clearly state the limits of coverage for different aspects, such as liability coverage, comprehensive coverage, and collision coverage.

- Understanding coverage limits helps policyholders determine if they have adequate protection in case of an accident or other covered event.

Exclusions

- Exclusions Artikel specific situations or events that are not covered by the auto insurance policy.

- Being aware of exclusions is important for policyholders to avoid any surprises when filing a claim for damages or losses.

Premiums

- Clearly stating the premium amount and any factors that may affect changes in premiums, such as driving record or vehicle type, promotes transparency in auto coverage plans.

- Policyholders should have a clear understanding of how premiums are calculated and what factors impact their insurance costs.

Role of Terms and Conditions

- Terms and conditions serve as the legal framework of the auto insurance policy, outlining rights, responsibilities, and obligations of both the insurer and the policyholder.

- Understanding and agreeing to the terms and conditions of the policy is essential for policyholders to avoid any misunderstandings or disputes during the claims process.

Building Trust through Transparent Communication

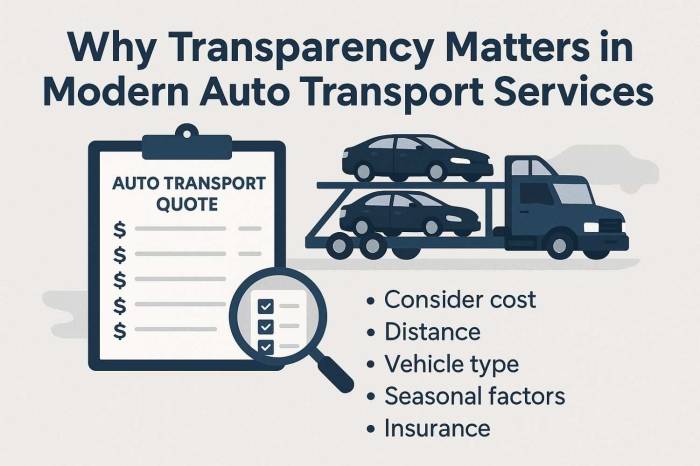

Transparency in communication plays a crucial role in fostering trust between insurers and policyholders. When insurers provide clear and honest information about coverage details, policyholders feel more confident in their insurance decisions.Effective Ways to Communicate Coverage Details Clearly

- Provide a detailed breakdown of coverage options, including deductibles, limits, and exclusions, in easy-to-understand language.

- Use visual aids such as charts or graphs to illustrate coverage details and make complex information more accessible.

- Offer online tools or resources that allow policyholders to explore their coverage options and understand their policy in-depth.

Impact of Transparent Communication on Customer Satisfaction and Retention

Transparent communication not only helps policyholders make informed decisions but also enhances their overall satisfaction with the insurance company. When customers feel that their insurer is honest and upfront about coverage details, they are more likely to renew their policies and recommend the company to others. This leads to higher customer retention rates and a positive reputation for the insurance provider.Regulatory Standards and Transparency

Regulatory standards play a crucial role in promoting transparency within the auto insurance industryRole of Regulatory Standards

Regulatory standards act as a guideline for insurance companies, outlining the necessary information that must be disclosed to policyholders. By adhering to these standards, insurers are required to be transparent about the coverage offered, including details on deductibles, limits, exclusions, and any additional fees.- Regulatory frameworks ensure that insurance companies do not mislead consumers and provide them with all the essential information needed to make informed decisions.

- Transparency regulations help build trust between insurers and policyholders, fostering a more honest and fair relationship.

- Non-compliance with these standards can lead to legal repercussions, fines, and damage to the reputation of the insurance company.

Comparison of Regulatory Frameworks

Different regulatory frameworks around the world may have varying requirements when it comes to ensuring transparency in auto coverage plans. While some jurisdictions may have stringent regulations with detailed disclosure requirements, others may have more lenient guidelines.| Stringent Regulations | Lenient Guidelines |

|---|---|

| Require insurers to provide extensive information on coverage terms and conditions. | May have fewer disclosure requirements, potentially leading to less transparency for policyholders. |

| Focus on protecting consumer interests and ensuring fair practices within the insurance industry. | Could result in policyholders not having access to crucial details about their coverage. |

Consequences of Non-Compliance

Failure to comply with transparency regulations in the insurance industry can have severe consequences for insurance companies. It can erode consumer trust, lead to legal action, and damage the reputation of the insurer. Additionally, non-compliance may result in financial penalties and regulatory sanctions, impacting the overall operations of the company.- Policyholders may feel misled or deceived if they discover hidden fees or undisclosed terms in their coverage plans.

- Regulators may intervene and investigate cases of non-compliance, imposing sanctions on insurers found to be in violation of transparency regulations.

- Overall, maintaining transparency in auto coverage plans is essential to uphold the integrity of the insurance industry and protect the interests of consumers.

Outcome Summary

In conclusion, transparency in auto coverage plans not only fosters trust between insurers and policyholders but also ensures clear communication and understanding of coverage details. By adhering to regulatory standards and promoting transparency, the insurance industry can enhance customer satisfaction and loyalty.

Questions and Answers

Why is transparency important in auto coverage plans?

Transparency is crucial as it helps policyholders understand their coverage, prevents misunderstandings, and builds trust between insurers and customers.

What are the consequences of non-compliance with transparency regulations?

Non-compliance can lead to legal issues, loss of customer trust, and regulatory penalties for insurers.

How do policy details contribute to transparency?

Clear policy details ensure that policyholders know what is covered, what is not, and any limitations or exclusions in their coverage.

How can insurers effectively communicate coverage details to customers?

Insurers can use simple language, provide clear explanations, and offer examples to help customers understand their coverage better.

![15+ Free Printable Vehicle Service Contract Letter [PDF]](https://auto.goodnewsfromindonesia.id/wp-content/uploads/2026/02/Vehicle-Service-Contract-1024x576-1.jpg)