Top Mistakes to Avoid When You Shop Car Insurance Quotes sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

When it comes to shopping for car insurance, making mistakes can be costly. This guide will highlight common pitfalls to steer clear of and ensure you get the best insurance deal possible.

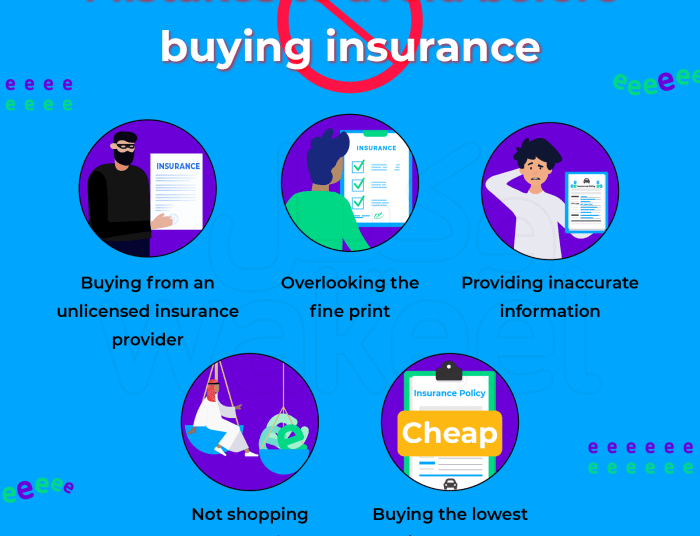

Common Mistakes When Shopping for Car Insurance

When shopping for car insurance, it's crucial to avoid common mistakes that could impact the coverage and cost of your policy. By steering clear of these pitfalls, you can secure the best insurance deal for your needs.

Not Comparing Multiple Quotes

One of the most common mistakes people make when shopping for car insurance is not comparing quotes from multiple providers. Failing to shop around can result in paying more for coverage than necessary. By obtaining quotes from different companies, you can find the most competitive rates and save money on your premiums.

Choosing the Wrong Coverage Limits

Selecting inadequate coverage limits or opting for unnecessary add-ons can also be a costly mistake. If you choose coverage limits that are too low, you may not have enough protection in the event of an accident. On the other hand, paying for coverage you don't need can lead to overspending.

It's essential to assess your needs carefully and select the right coverage levels for your situation.

Overlooking Discounts

Another mistake to avoid is overlooking discounts that could help lower your insurance premiums. Many insurance companies offer discounts for things like safe driving records, bundling policies, and vehicle safety features. By taking advantage of these discounts, you can reduce the cost of your coverage significantly.

Not Reviewing Policy Details

Failing to review the details of your policy before purchasing can lead to surprises down the road. Make sure you understand what is covered, what is excluded, and any terms or conditions that may apply. By clarifying these details upfront, you can avoid misunderstandings and ensure you have the coverage you need.

Overlooking Coverage Needs

When shopping for car insurance, it is crucial to assess your individual coverage needs to ensure you are adequately protected in case of accidents. Failing to consider your specific requirements can result in inadequate coverage and financial risk.

Factors to Consider for Determining Coverage

- Value of Your Vehicle: Consider the current market value of your car to determine if comprehensive or collision coverage is necessary.

- State Requirements: Familiarize yourself with the minimum insurance requirements in your state to avoid any legal issues.

- Driving Habits: Evaluate how often you drive, where you drive, and who else drives your car to determine the level of coverage needed.

- Financial Situation: Assess your financial stability and ability to cover potential out-of-pocket expenses in the event of an accident.

Overlooking coverage needs can leave you vulnerable to significant financial losses if you are involved in a car accident without adequate insurance protection.

Focusing Solely on Price

When shopping for car insurance, it is common for individuals to focus solely on the price of insurance quotes. While affordability is an important factor to consider, it is crucial not to overlook the coverage provided by the policy. Choosing the cheapest option may seem like a cost-effective decision initially, but it can lead to limited coverage and potential financial risks in the long run.

Examples of Limited Coverage with Cheapest Option

- Choosing a policy with the minimum required coverage may leave you vulnerable in case of accidents or damages that exceed the limits.

- Opting for a policy with a high deductible to lower the premium cost could result in significant out-of-pocket expenses in the event of a claim.

- Selecting a policy with bare-bones coverage may not provide adequate protection for your specific needs, such as comprehensive coverage for theft or vandalism.

Finding the Balance Between Cost and Coverage

It is essential to strike a balance between cost and coverage when selecting a car insurance policy. By evaluating your insurance needs, driving habits, and budget, you can identify the most suitable policy that offers adequate protection without compromising on affordability.

Comparing quotes from multiple insurers and considering the value of coverage provided can help you make an informed decision that meets your requirements effectively.

Not Comparing Quotes from Multiple Providers

When shopping for car insurance, one common mistake is not comparing quotes from multiple providers

Importance of Obtaining Multiple Quotes

- Comparing quotes from various providers allows you to get a comprehensive view of the available options in the market.

- By obtaining quotes from multiple companies, you can identify competitive rates and potentially save money on your insurance premiums.

- Each insurance provider may offer different coverage options and discounts, so comparing quotes helps you find a policy that best suits your needs.

Tips for Effective Comparison

- Ensure you provide accurate and consistent information when requesting quotes to receive reliable estimates.

- Look beyond the price and consider the coverage and benefits offered by each policy to assess the overall value.

- Take note of any exclusions or limitations in the policies to understand what is and isn't covered.

Benefits of Comparing Quotes

- Comparing quotes can help you find competitive rates and potentially negotiate better deals with insurance companies.

- It allows you to tailor your coverage to match your specific needs and budget, ensuring you get the most value out of your policy.

- By exploring different options, you can avoid overpaying for coverage that you may not need or missing out on essential protections.

Providing Inaccurate Information

Accurate information is crucial when obtaining car insurance quotes as it directly impacts the coverage you receive and the premium you pay. Providing incorrect details can lead to serious consequences and affect the overall policy.

Importance of Providing Accurate Information

- Insurance companies use the information provided to assess risk and determine the appropriate coverage and premium.

- Incorrect information can result in denied claims or policy cancellations if discrepancies are discovered later on.

- Accurate details ensure you are adequately covered in case of an accident or other unforeseen events.

Consequences of Providing Incorrect Details

- Policy may be voided or canceled due to misrepresentation.

- Claims may be denied if inaccuracies are discovered during the claims process.

- Premium rates may increase if discrepancies are found after the policy is issued.

Tips for Ensuring Accuracy

- Double-check all information provided on the application form before submission.

- Provide updated and truthful information, especially regarding driving history, vehicle details, and personal information.

- Communicate any changes in circumstances to your insurance provider to keep your policy up to date.

Final Conclusion

In conclusion, being aware of the top mistakes to avoid when shopping for car insurance quotes can save you both money and stress in the long run. By sidestepping these pitfalls and staying informed, you can secure the right coverage at the right price.

Expert Answers

What factors should I consider when determining my coverage needs?

Factors to consider include your vehicle's value, your driving habits, and whether you have any outstanding loans on the car.

How can providing inaccurate information impact my car insurance policy?

Providing inaccurate information can lead to your policy being voided or claims being denied in case of an accident. It's crucial to be honest and precise.

Why is it important to compare quotes from multiple providers?

Comparing quotes allows you to find the best rates and coverage options available in the market, ensuring you make an informed decision.