Exploring the world of Vehicle Protection Plans for New vs Used Cars, this guide aims to shed light on the differences between protection plans for new and used vehicles. From coverage options to claim processes, this article will provide you with all the essential information you need to make an informed decision.

Overview of Vehicle Protection Plans

Vehicle protection plans, also known as extended warranties, are service contracts that provide coverage for certain repairs and maintenance beyond the manufacturer's warranty period. These plans are designed to protect car owners from unexpected and costly repairs.

Coverage Options for New and Used Cars

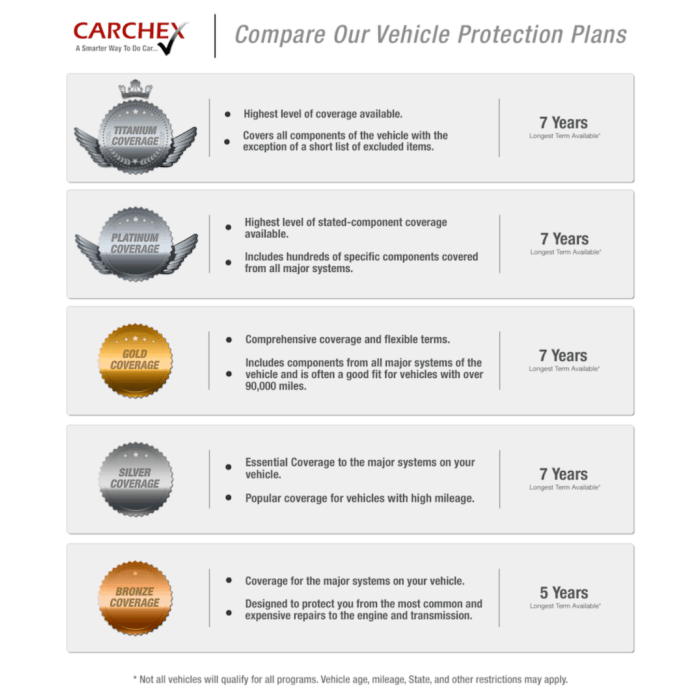

Vehicle protection plans offer a range of coverage options tailored to different needs and budgets. Here are some common coverage options for both new and used cars:

- Powertrain Coverage: This option covers essential components like the engine, transmission, and drivetrain.

- Bumper-to-Bumper Coverage: Also known as comprehensive coverage, this plan includes a wide range of vehicle components, excluding only a few specific items.

- Roadside Assistance: This coverage provides services like towing, fuel delivery, and roadside repairs in case of a breakdown.

Benefits of Having a Vehicle Protection Plan

Having a vehicle protection plan can offer several benefits for car owners, including:

- Financial Protection: It can help cover the cost of unexpected repairs, saving you money in the long run.

- Peace of Mind: Knowing that your vehicle is covered can provide peace of mind and eliminate the stress of dealing with unexpected breakdowns.

- Convenience: Vehicle protection plans often include added benefits like roadside assistance, rental car coverage, and trip interruption benefits, making it more convenient to deal with emergencies.

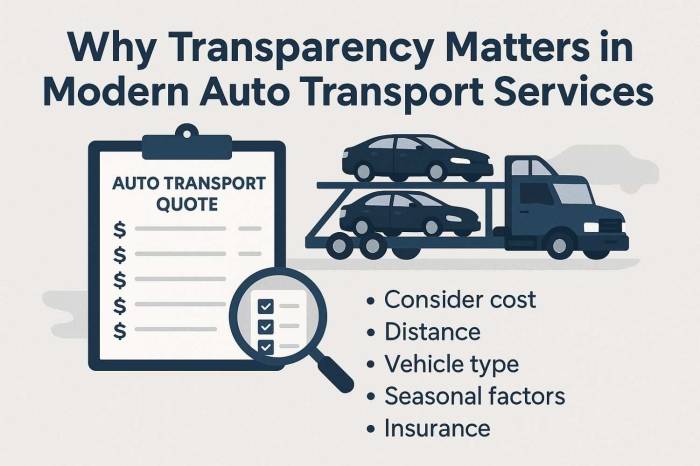

Factors to Consider When Choosing a Plan

When deciding on a vehicle protection plan, there are several factors to take into account to ensure you have the right coverage for your car.Cost Discrepancies between New and Used Cars

- Vehicle protection plans for new cars are generally more expensive than those for used cars due to the higher value and lower risk of potential issues in newer vehicles.

- Used cars typically have lower plan costs, but the coverage may be limited compared to plans for new cars.

Differences in Coverage

- Plans for new cars often include comprehensive coverage for various components, including technology features, while plans for used cars may have more restrictions and exclusions.

- Used car plans may have higher deductibles or limitations on certain repairs, depending on the age and mileage of the vehicle.

Impact of Age and Mileage

- The age and mileage of a car are crucial factors in determining the type of protection plan needed.

- Newer cars may benefit more from extended warranty coverage, while older cars with higher mileage might require more extensive coverage for potential mechanical issues.

Manufacturer vs Third-Party Plans

When it comes to vehicle protection plans, there are two main types to consider: manufacturer-backed plans and third-party plans. Each type has its own set of advantages and disadvantages that consumers should be aware of before making a decision.Manufacturer-Backed Plans

Manufacturer-backed plans are typically offered by the same company that produced the vehicle. These plans are often seen as more reliable and comprehensive since they are directly affiliated with the vehicle manufacturer. Examples of popular manufacturers offering these plans include Ford, Toyota, and Honda.- Advantages:

- Direct relationship with the manufacturer for seamless service.

- Potentially better coverage tailored to the specific vehicle.

- Access to genuine parts and certified technicians.

- Disadvantages:

- May be more expensive compared to third-party plans.

- Limitations on where repairs can be done.

- Could be tied to specific dealerships for service.

Third-Party Plans

Third-party plans are offered by independent companies not affiliated with the vehicle manufacturer. While these plans may offer more flexibility and potentially lower costs, they may also come with some drawbacks.- Advantages:

- Potentially lower cost compared to manufacturer-backed plans.

- Wider range of coverage options available.

- Ability to choose where repairs are done.

- Disadvantages:

- Less direct relationship with the vehicle manufacturer.

- Potential for delays in claim processing.

- Quality of parts and service providers may vary.

Claim Process and Customer Experience

When it comes to vehicle protection plans, understanding the claim process and customer experience is crucial for ensuring a smooth and hassle-free experience in case of unexpected repairs or breakdowns.

When it comes to vehicle protection plans, understanding the claim process and customer experience is crucial for ensuring a smooth and hassle-free experience in case of unexpected repairs or breakdowns.Filing a Claim

- Notify the warranty provider: Contact the warranty provider as soon as the need for a repair arises.

- Provide necessary documentation: Be prepared to provide documentation such as the service contract, repair invoices, and maintenance records.

- Get authorization: Before proceeding with any repairs, ensure you receive authorization from the warranty provider.

- Choose an authorized repair facility: Work with authorized repair facilities approved by the warranty provider for covered repairs.

Customer Experiences

- Positive experiences: Some customers have reported seamless claim processes with quick approvals and minimal paperwork.

- Negative experiences: Others have faced challenges with claim denials, delays in processing, or disputes over coverage.

- Communication is key: Clear communication between the customer, repair facility, and warranty provider can help streamline the claim process.

Tips for a Smooth Claim Process

- Maintain records: Keep thorough records of maintenance and repairs to support your claim.

- Follow procedures: Adhere to the specific procedures Artikeld by the warranty provider for filing claims.

- Stay informed: Understand what is covered and excluded under your plan to avoid any surprises during the claim process.

- Ask questions: If you have any doubts or concerns about the claim process, don't hesitate to ask for clarifications from the warranty provider.

Final Conclusion

In conclusion, understanding the nuances of Vehicle Protection Plans for New vs Used Cars is crucial in ensuring the longevity and safety of your vehicle. Whether you opt for a manufacturer-backed plan or a third-party provider, knowing the ins and outs of these plans can save you time, money, and stress in the long run.

Key Questions Answered

What are the key differences between manufacturer-backed and third-party vehicle protection plans?

Manufacturer-backed plans are typically offered by the car's original manufacturer and may provide more comprehensive coverage specific to the brand. Third-party plans, on the other hand, are offered by independent companies and may offer more flexibility in terms of coverage options.

How does the age and mileage of a car impact the type of protection plan needed?

The age and mileage of a car can affect the eligibility for certain coverage options. Newer cars may qualify for more extensive coverage, while older vehicles with higher mileage might be limited in the types of plans available.

What are some common coverage options included in vehicle protection plans for new cars?

Common coverage options for new cars include bumper-to-bumper warranties, powertrain warranties, and extended warranties that cover major components like the engine and transmission.

How can I ensure a smooth claim process under a vehicle protection plan?

To ensure a hassle-free claim process, be sure to follow the guidelines Artikeld in your plan, keep detailed records of maintenance and repairs, and promptly report any issues to your provider.

![15+ Free Printable Vehicle Service Contract Letter [PDF]](https://auto.goodnewsfromindonesia.id/wp-content/uploads/2026/02/Vehicle-Service-Contract-1024x576-1.jpg)

![15+ Free Printable Vehicle Service Contract Letter [PDF]](https://auto.goodnewsfromindonesia.id/wp-content/uploads/2026/02/Vehicle-Service-Contract-1024x576-1-75x75.jpg)